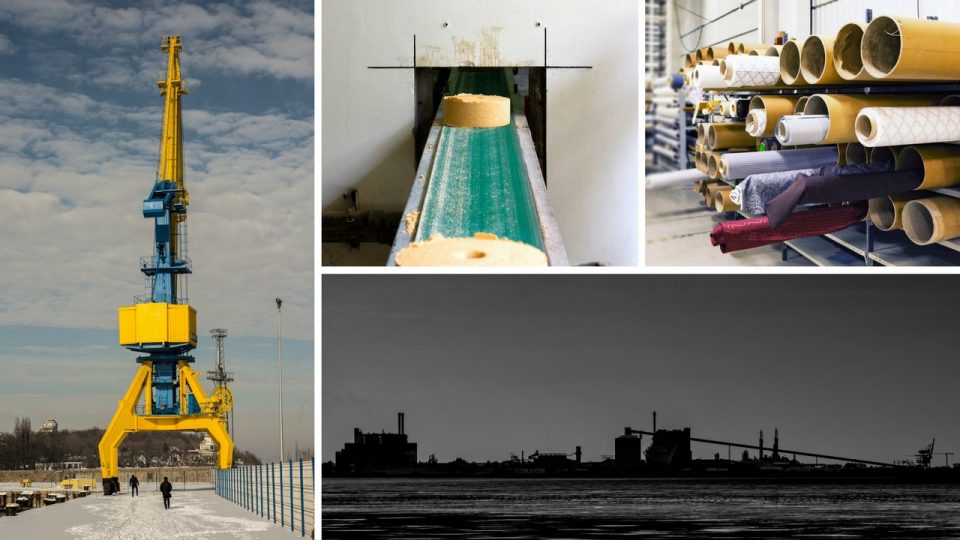

Industrial insurance

RAPID

SPECIALISTS

Warranty offers for manufacturers

Producers and manufacturers in the agricultural, assembly, food processing, parts and product manufacturing sectors, among others, can take advantage of a dedicated offer that takes into account their particular needs and expectations, as well as the unique characteristics of each activity.

A customized insurance offer for every manufacturer

At Assur360, we take into account the particularities of each manufacturer to offer tailor-made solutions. Thanks to the expertise and know-how of the experts at this corporate insurance firmWith Assur360, every professional can choose the coverage that suits them best. Assur360 offers a personalized, local service to all its customers.

Assur360 responds quickly and efficiently in the event of a claim to support its customers wherever they are in Quebec.

Guarantees for industrial entities

The industrial sector is one of the most sensitive, but also one of the most demanding in terms of business insurance. In fact, economic players in the industrial sector are obliged to ensure productivity, efficiency and compliance with standards in order to meet market requirements and keep up with the competition. But now they can work with complete peace of mind, thanks to the optimum coverage offered by Assur360. This insurance is designed to support them in their development by covering the various risks and claims associated with this type of activity, including civil liability, environmental incidents and pollution, among others.

Save money by comparing insurance quotes from metal fabricators

A welding accident or stolen fabrication equipment can cost your company thousands of dollars. Protect your business with low-cost insurance for welders and metal fabricators.

When there's a blockage in the market following a request for a quote, it's always possible to unblock it. The trick is to get the broker you want to deal with to sign a letter of bid exclusivity.

In this case, the insurer will have to unblock the deal. Just bear in mind that signing a contract with a broker is not automatic. It is also possible to use a letter of transfer of the insurance policy from one insurer to another.

The most important thing is to establish a sound relationship with your insurer, so that you can benefit from the right business coverage while making the most of your broker's assistance and support.

Managing your industrial insurance risks

Optimizing protection for your manufacturing business

Insurance risk management in the manufacturing industrial sector is essential to ensure the long-term survival and prosperity of your business. The risks inherent to this sector require a strategic approach to ensure adequate protection. Find out how to optimize your insurance risk management to ensure the continuity of your manufacturing business.

In-depth risk assessment

The first crucial step is to carry out a thorough assessment of the risks to which your manufacturing business is exposed. This includes identifying operational risks such as industrial accidents, equipment breakdowns and production interruptions, as well as external risks such as market fluctuations and regulatory changes.

Customize your insurance coverage

Based on the risk assessment, customize the insurance coverage to meet your company's specific needs. This may include liability insurance for damage caused to third parties, property insurance to cover manufacturing equipment and facilities, and business interruption insurance to cover financial losses in the event of production stoppage.

Integrating risk prevention

Risk prevention plays a key role in overall insurance risk management. Implement preventive measures such as strict safety procedures, staff training and preventive equipment maintenance. A proactive approach to risk prevention can reduce incidents and minimize potential financial losses.

Collaboration with insurance experts

Work with insurance experts who specialize in the manufacturing sector. A broker or insurer with in-depth knowledge of the challenges faced by the specific risk management can help you design a comprehensive insurance strategy tailored to your operational reality.

Periodic review of insurance strategy

Your company's needs change over time. An insurance strategy Effective insurance coverage needs to be reviewed periodically to adapt to changes in your business, market developments and new emerging risks. Make sure your insurance coverage remains aligned with the objectives and realities of your manufacturing business.

Anticipating future challenges

In addition to managing current risks, anticipate future challenges. This can include identifying market trends, anticipating technological developments, and preparing for new emerging risks. A proactive approach ensures that your company is ready to face the future with confidence.

By working withhelp from an insurance broker and effective insurance risk management in the manufacturing industrial sector, you strengthen your company's resilience. A personalized approach, focused on prevention and regularly reviewed, ensures that your insurance coverage evolves with your business to ensure its long-term continuity and growth.

What is industrial insurance for manufacturers?

Answer: Manufacturers' industrial insurance is a type of insurance coverage designed to protect manufacturing companies against industry-specific risks. It can include product liability, property coverage, business interruption, and other types of risk such as equipment damage and litigation.

Sommaire

Toggle