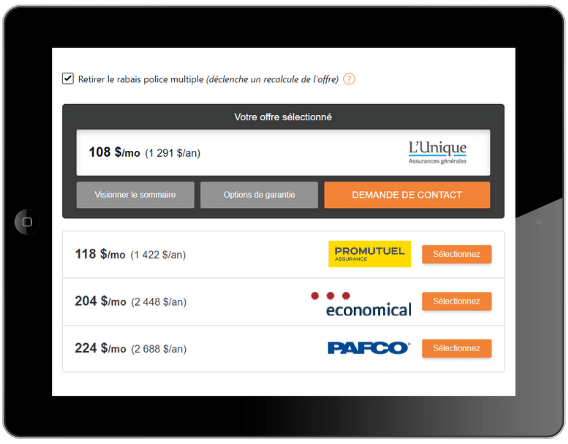

Home and auto insurance quote

Independent broker 100%

Our new 360° concept is there to offer you products with coverage based on your real needs, saving you time and money. We're much more than just a comparator!

Talk to your favorite broker when you feel like it!